Filing FBAR as a US expat abroad - 2022 Guide to fill out your yearly report for free!

What is the FBAR?

Do I need to file the FBAR?

The US requires their citizens to file taxes and an FBAR, even if they are no longer reside there (you live abroad). In addition, the government requires residents to file it if they have signification foreign holdings ($10,000 or more). Their justification is so the US government to know that people are not involved in any financial fraud abroad.

When you are a US citizen and sign up for a bank account in a foreign country (with a US tax treaty), 99% of the time they will also have you fill out a W9, bring your US identification and store your social security number. These countries often collaborate and share information with each other anyways. That is why you should be filing the FBAR, because if they find out that you have met the minimum threshold but didn't file you will be penalized.

How to file:

The FBAR is more straightforward than taxes and can be done by yourself in a matter of minutes (if you have 1 or 2 bank accounts). No lawyer, tax preparer, or accountant is necessary for most cases.

If you hold or have access to multiple accounts, each requires their own "form", click plus on the relevant page for how many accounts you have of that type. Now you will need to write each one in it's own page (not aggregated into a single one).

If the aggregate value of those foreign financial accounts exceeded $10,000 at any time during the calendar year reported, you are required to fill out the FBAR.

The exchange rate is based on the 12th month (December) at the 31st day of that year, you can download the spreadsheet from the Treasury. There is too much information that isn't necessary... All you need to do is: make sure you are at the right date 12/31/YEAR, then do a find all for your selected currency. and write that down/save it for your conversions later.

Alternatively, I compiled a list here which will make your life way easier:

For people residing in Israel, I already did the work and this is the exchange rate (official) as of 12/31/2021. FBAR and taxes are reporting for the prior year, so even though it's 2022... the report is only in relation to the 2021 fiscal year.

on 12/31/2021, the Israel-Shekel was at the rate of 3.099 for every 1 US dollar.

This means that a single dollar was worth 3.099 shekels at that time. This is the exchange rate that you will be calculating your account balance with.

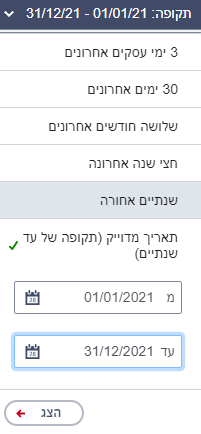

For Bank Hapoalim, you can get a report of the yearly transactions here:

Come join our deals group to never miss out on upcoming sales

אתם מוזמנים להצטרף לקבוצת דילים שלנו

Comments

Post a Comment

Thank you for commenting! This will be approved by a moderator shortly.